New MSME definition announced by GoI. Effective 1st April 2025! Please see link: https://udyamregistration.gov.in/docs/261838_220191.pdf

New MSME definition announced by GoI. Effective 1st April 2025! Please see link: https://udyamregistration.gov.in/docs/261838_220191.pdf

MSMEs are the backbone of the Indian economy. Accounting for 37.5 per cent of the country’s GDP, MSMEs provide employment for 117.1 million people. Despite their role in the Indian economy, the companies face several challenges such as accessing funds from the formal banking channels, time delays, increasing demand for collateral by the financiers, etc.

With a view to resolve the credit challenges faced by the access to formal banking channelsMSMEs, RBI set up the Trade Receivables Discounting System (TReDS) platform. TReDS is an electronic exchange that allows transparent and online selling of receivables by MSMEs through factoring. A.TReDS Ltd. (a joint venture between Axis Bank and mjunction services), received the licence for the TReDS platform on June 29, 2017 and started operations on July 5,, 2017. Invoicemart is the TReDS platform promoted by A.TReDS Ltd.

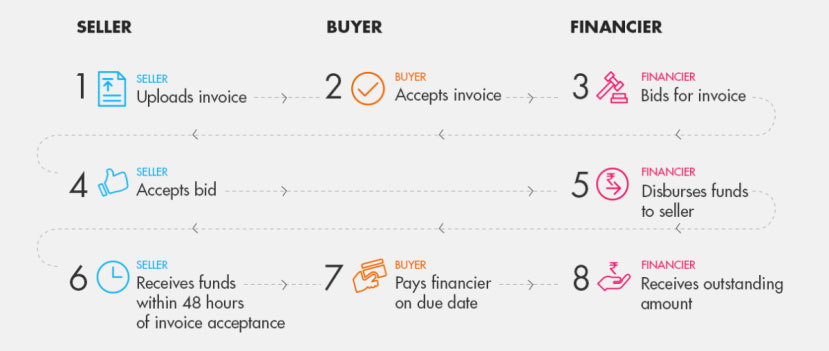

Factoring – a financial transaction in which the business organisation sells its book debts/unpaid invoices/receivables to a financial institution at a discount – is a new avenue for MSMEs to get working capital finance quickly and quickly at a better rate quickly. Let’s look at the processes in detail.

Factoring: A factoring transaction begins when a seller uploads an invoice and creates a factoring unit (FU). The FU contains necessary details of the invoice in digital format, must be accepted by the buyer before it is sent to financiers for bidding. The seller then chooses the most suitable bid and receives funds from the financier within 48 hours. On the due date of payment, the buyer pays the outstanding amount to the financier.

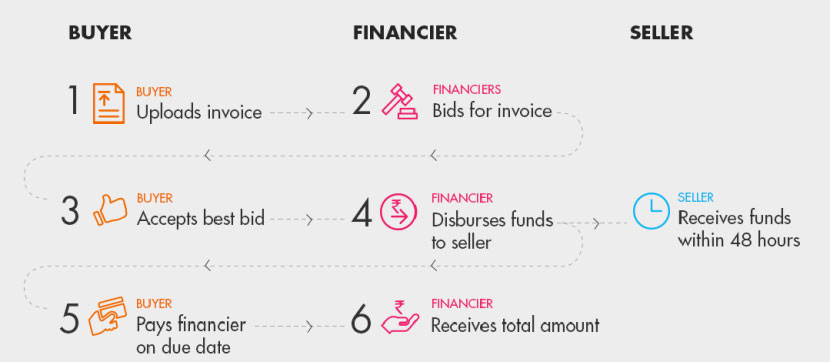

Reverse factoring

A reverse factoring transaction begins when a buyer uploads an invoice on the platform, on behalf of the seller and creates a factoring unit (FU). An FU contains necessary details of the invoice in digital format which is sent to the financiers for bidding. The buyer then chooses the most suitable bid. The seller receives funds from the financier within 48 hours. On the due date of payment, the buyer pays the outstanding amount to the Financier.

TReDS aAdvantages

It will take some time for factoring to become a mainstream mode of financing as a large chunk of MSMEs are not even aware of the exchange. However, TReDS can go a long way in securing the financial stability and future of the MSMEs.

How to participate:To join Invoicemart, all you need to do is sign a one-time master agreement with A.TReDS and ensure the buyer also does the same if not already registered. For more details, please write to us at helpdesk@invoicemart.com, or call us at 022 6235 7373/022 4975 7373.